What Can Toilet Paper Teach Us About Poverty?

“Costco is where you go broke saving money.”

-My Uncle

The fundamental paradox of big box stores is that the only way to save money is to spend lots of it. Want to get a discount on that shampoo? Here's a liter. That’s a great price for chapstick – now you have 32 of them. The same logic applies to most staples of modern life, from diapers to Pellegrino, Uni-ball pens to laundry detergent.

For consumers, this buy-in-bulk strategy can lead to real savings, especially if the alternative is a bodega or Whole Foods. (Brand name diapers, for instance, cost nearly twice as much at my local grocery store compared to Costco.) However, not every American is equally likely to seek out these discounts. In particular, some studies have found that lower-income households – the ones who could benefit the most from that huge bottle of Kirkland shampoo – pay higher prices because they don’t make bulk purchases.

A new paper, “Frugality is Hard to Afford,” by A. Yesim Orhun and Mike Palazzolo investigates why this phenomenon exists. Their data set featured the toilet paper purchases of more than 100,000 American families over seven years. Orhun and Palazzolo focused on toilet paper for several reasons. First, consumption of toilet paper is relatively constant. Second, toilet paper is easy to store – it doesn’t spoil – making it an ideal product to purchase in bulk, at least if you’re trying to get a discount. Third, the range of differences between brands of toilet paper is rather small, at least when compared to other consumer products such as detergent and toothpaste.

So what did Orhun and Palazzolo find? As expected, lower income households were far less likely take advantage of the lower unit prices that come with bulk purchases. Over time, these shopping habits add up, as the poorest families end up paying, on average, 5.9 percent more per sheet of toilet paper.

The question, of course, is why this behavior exists. Shouldn’t poor households be the most determined to shop around for cheap rolls? The most obvious explanation is what Orhun and Palazzolo refer to as a liquidity constraint: the poor simply lack the cash to “invest” in a big package of toilet paper. As a result, they are forced to buy basic household supplies on an as-needed basis, which makes it much harder to find the best possible price.

But this is not the only constraint imposed by poverty. In a 2013 Science paper, the behavioral scientists Anandi Mani, Sendhil Mullainathan, Eldar Shafir and Jiaying Zhao argued that not having money also imposes a mental burden, as our budgetary worries consume scarce attentional resources. This makes it harder for low-income households to plan for the future, whether it’s buying toilet paper in bulk or saving for retirement. “The poor, in this view, are less capable not because of inherent traits,” write the scientists, “but because the very context of poverty imposes load and impedes cognitive capacity.”

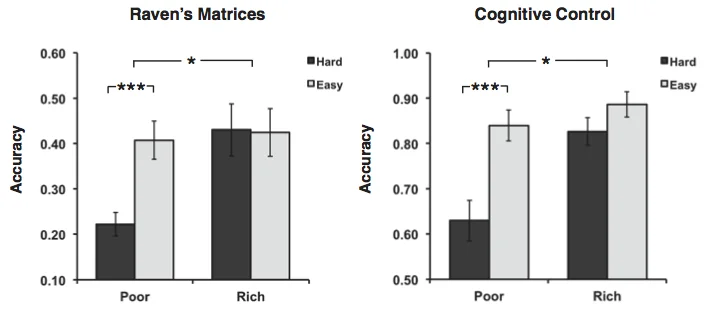

Consider a clever experiment conducted by Mani, et al. at a New Jersey mall. They asked shoppers about various hypothetical scenarios involving a financial problem. For instance, they might be told that their “car is having some trouble and requires $[X] to be fixed.” Some subjects were told that their repair was extremely expensive ($1500), while others were told it was relatively cheap ($150.) Then, all participants were given a series of challenging cognitive tasks, including some questions from an intelligence test and a measure of impulse control.

The results were startling. Among rich subjects, it didn’t really matter how much the car cost to fix – they performed equally well when the repair estimate was $150 or $1500. Poor subjects, however, showed a troubling difference. When the repair estimate was low, they performed roughly equivalent to rich subjects. But when the repair estimate was high they suddenly showed a steep drop off in performance on both tests, comparable in magnitude to the mental deficit associated with losing a full night of sleep or becoming an alcoholic.

This new toilet paper study provides some additional evidence that poverty takes a toll on our choices. In one analysis, Orhun and Palazzolo looked at how purchase behavior was altered at the start of the month, when low income households are more likely to receive paychecks and food stamps. As the researchers note, this influx of money should temporarily ease the stress of being poor, thus making it easier to buy in bulk.

That’s exactly what they found. When the poorest households were freed from their most pressing liquidity constraints, they made much more cost-effective toilet paper decisions. (This also suggests that poorer households are not simply buying smaller bundles due to a lack of storage space or transportation, as these factors are not likely to exhibit week-by-week fluctuation.) Of course, the money didn't last long; the following week, these households reverted back to their old habits, overpaying for household products. And so those with the least end up with even less.

Orhun, A. Yesim, and Mike Palazzolo. "Frugality is hard to afford." University of Michigan Working Paper (2016).

Mani, Anandi, Sendhil Mullainathan, Eldar Shafir, and Jiaying Zhao. "Poverty impedes cognitive function." Science 341 (2013): 976-980.